Supplies of Critical Nasal Spray for Hemophilia A, von Willebrand Disease Restored, but Patients and Coverage Recede

STAQ, a 503B outsourcing facility, started making desmopressin nasal spray after Ferring Pharmaceuticals suspended production nearly three years ago.

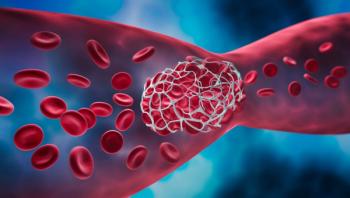

Nearly three years after Ferring Pharmaceuticals suspended production of nasal sprays that boost blood clotting in people with Type 1 von Willebrand disease and hemophilia A, it remains unclear if — or when – the company will resume production.

The production was suspended due to a packaging seal problem that led to evaporation and potentially dangerously high concentrations of the active ingredient, desmopressin.

Desmopressin is a synthetic form of vasopressin, a naturally occurring hormone with a wide range of effects that influence blood pressure, blood volume, urination and kidney function. As it turns out, increasing the levels of von Willebrand factor and factor VIII, the clotting factor that people with hemophilia A are short on, is also in vasopressin’s bag of tricks and therefore desmopressin’s. Desmopressin is the active ingredient in DDAVP nasal spray and Stimate. The two brand-names tend to get used interchangeably, although Stimate is actually a higher-concentration product.

Patients who previously used DDAVP nasal spray or Stimate have been prescribed clotting factor instead, which is more costly and requires intravenous infusion. In addition, clotting factor can lead to inhibitor development in patients with hemophilia A, adding to the difficulty and cost of care.

To bridge the gap, the

“Since the July 2020 recall, many patients who relied on (desmopressin acetate) for bleeding control have experienced serious hardship, including worsening health condition. Desmopressin acetate nasal spray has been an important therapeutic solution for these patients for management of bleeding complications and to facilitate surgical procedures and has been a first-line therapy for more than 25 years,” members of the Hemophilia Alliance wrote in a letter to payers urging them to cover the STAQ Pharma product.

STAQ Pharma is producing the drug for a wholesale cost of about $400 per vial, with roughly 6 actualizations, or uses, which is $80 less than the original Ferring cost, according to Joe Pugliese, president and CEO of the Hemophilia Alliance.

Still, it has been difficult to get payers to reimburse for this product, he said.

“We've talked to the FDA several times about what we would have to do to get an abbreviated New Drug Application,” which would give the STAQ Pharma drug generic status and potentially improve the argument for payer coverage.

“Those conversations with the FDA have not been going quickly, which means that reimbursement and distribution are challenging at times. Support from pharmacy benefit managers has been mixed. Of course, hemophilia treatment centers and the smaller home care companies around the country have been purchasing the product and making it available to patients with good results,” Pugliese said.

The uncertainty and interruption in supply has affected the size of the market for this drug despite its advantages over intravenous clotting factor.

“Some people moved to subcutaneous desmopressin acetate. Some people have moved to factor concentrates,” Pugliese said. However, about 2,000 vials of the STAQ Pharma nasal spray have been shipped since 2021. “Getting the word out and then getting the patients connected with the product have been slow, but we continue to grow every month," Pugliese said.

Advocates for patients with hemophilia are also interested in STAQ Pharma producing supplies of another product for bleeding control called Amicar (aminocaproic acid), which Acorn Pharmaceuticals discontinued because of its Chapter 7 bankruptcy, announced in February 2023. There are other suppliers of this product, though, so the FDA may not want to add it to the drug shortage list.

“If at some point in time we find that bleeding disorder patients couldn't get access to this product, we'd probably go back to the FDA,” Pugliese said.

Newsletter

Get the latest industry news, event updates, and more from Managed healthcare Executive.