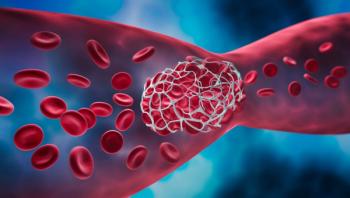

Gene Therapy for Hemophilia Is Becoming a Reality. Who Will Write the Checks to Pay for It?

Hemgenix for hemophilia B is priced to cost $3.5 million per treatment. Roctavian for hemophilia A may be approved by the FDA in July and is likely to be priced to cost between $2 million and $3 million per treatment.

Gene therapy has been considered

The FDA is also due to make an approval decision about Roctavian (valoctocogene roxaparvovec), a gene therapy for hemophilia A, which is more common than hemophilia B. The decision was scheduled for this week but the so-called PDUFA date — named for Prescription Drug User Fee Act, which requires the FDA to make timely approval decisions — was moved out to June 30 to give the FDA more time to review data recently submitted by the drug’s maker, BioMarin Pharmaceutical.

Data from the clinical trials of Hemgenix and Roctavian suggest that they could, in fact, be the cures envisioned by the gene therapy researchers. There is, though a major caveat: Patients have not been followed for that long. The “durability” of gene therapy, as measured by whether patients eventually need transfusions of clotting factors again, is uncertain, say experts. If patients need clotting factors a few years after receiving the gene therapy, labeling the gene therapies a “cure” may be seen as an overstatement.

Still, the trial results have been impressive for the time periods involved. In the HOPE-B trial of Hemgenix, 96% of patients (N = 54)

But the price of the gene therapy is staggering. The wholesale acquisition cost price — the list price before any sort of discounting or other price arrangement— of Hemgenix is $3.5 million. Pharmaceutical industry observers expect Roctavian to be priced between $2 and $3 million.

The drugmakers say the price is justified because the gene therapies will mean avoiding the costs of clotting factor treatments, which are themselves expensive, costing more a $1 million per year for those who develop immune system resistance to the factor replacement treatments. If they prove to be durable so patients don't need treatment with clotting factor, the gene therapies could pay for themselves in a relatively short period of time.

Payers may not look at it that way, noted independent healthcare analyst Joshua Cohen in a recent

The rate of turnover of plan participants may mean payers don't realize the long-term savings from getting patients off factor therapy. “Payers will take notice of the high upfront costs per patient” for gene therapy, Cohen wrote.

Moreover, if the durability of the gene therapy is relatively short lived, payers could be looking at the cost of the gene therapy and many years of clotting factor treatment.

From the perspective of insurers and the people who mind their budgets, the saving grace of Hemgenix is that hemophilia B is a rare disease, affecting just 6,000 people in the United States, most of them men. Just 15% of those require factor IV therapy, and a smaller number are expected to be appropriate candidates for Hemgenix. That limited exposure may reduce payer opposition to covering Hemgenix. A particular health plan may go for years without seeing a claim.

Roctavian and hemophilia A is a different story. Hemophilia A is the most common inheritable coagulation deficiency and affects between four to five times as many people as hemophilia B, and roughly 60% present with the severe form of hemophilia A and B, requiring prophylactic injections to maintain hemostasis.

Therefore, patients with hemophilia A represent a bigger liability. And the arrival of newer factor therapies with high price tags may push payers toward a wider embrace of gene therapy.

Eloctate (efmoroctocog alfa), approved in 2014, costs Medicaid $951,166 per patient per year; and Sanofi US said its recently approved Altuviiio [antihemophilic factor (recombinant), Fc-VWF-XTEN fusion protein-ehtl] will be priced at parity to this.

At these prices, payers would need slightly under three years to break even on the cost of Roctavian gene therapy.

Leslie Fish, vice president of

“If you are well controlled, even with moderate or severe disease, on Hemlibra (emicizumab-kxwh) or long-acting factor 8 you and your physician may decide not to use the product right away to wait and see the risk and the benefit is,” Fish said. “So we really think the initial use will probably be in those patients who are having more acute bleeds, they are using more factor 8 product, those are the patients who will probably use it at the beginning.

Newsletter

Get the latest industry news, event updates, and more from Managed healthcare Executive.