Caps on Out-of-Pocket Insulin Costs Don’t Increase Utilization

New research looks at the impact of state-level caps on out-of-pocket costs for insulin. Before the caps, most commercial enrollees were already paying costs below the cap amounts.

State-level caps on insulin out-of-pocket costs do not significantly increase insulin claims for patients with type 1 or type 2 diabetes, according to a new study

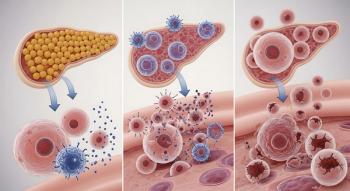

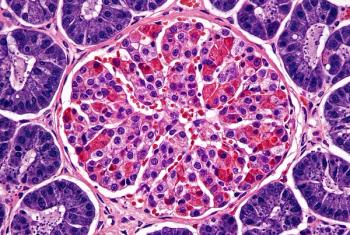

About 38 million adults and children in the United States have either type 1 or type 2 diabetes, according to

But about one-quarter of patients who use insulin report underuse because of cost, and researchers in a recent analysis point out that for patients who have type 1 diabetes and patients who use insulin to manage type 2 diabetes, list prices for insulin more than tripled from 2007 to 2018.

Concerns about high out-of-pocket costs for patients have prompted more than 20 states have implemented monthly caps on insulin out-of-pocket spending, ranging from $25 to $100 for patients. For example, Colorado, where the researchers who conducted this study reside, implemented a $100 cap that went into effect Jan. 1, 2020, for fully-insured plans. Other states followed, the authors said, including Utah, which implemented a $30 cap for commercial enrollees in plans that began January 2021.

Caps on out-of-pocket expenditures have been seen as a way to protect patients from these high prices. The Inflation Reduction Act of 2022 included provisions that capped out monthly out-of-pocket costs at $35 for insulin covered by Medicare Part D starting Jan. 1, 2023, and by Part B starting July 1, 2023.

Researchers at the University of Colorado Anschutz Medical Campus wanted to look at the effects of these state efforts to cap insulin out-of-pocket costs. Led by Kelly E. Anderson, Ph.D., MPP, assistant professor at the University of Colorado Skaggs School of Pharmacy and Pharmaceutical Sciences, researchers used a difference-in-differences design to evaluate out-of-pocket costs and insulin use.

Researchers assessed data for more than 33,000 patients with type 1 or type 2 diabetes enrolled in commercial insurance plans in states that both did and did not have out-of-pocket cap plans in place. The data were included in the 25% sample of the IQVIA PharMetrics database during 2018 to 2021, before and after the caps were implemented. The caps ranged from ranging $25 to $100.

Patients assessed were between the ages of 18 and 64. Included were 3,593 patients with type 1 diabetes and 18,318 patients with type 2 diabetes who used insulin.

Researchers in this analysis found that state caps on out-of-pocket costs did not increase insulin use for commercial enrollees with type 1 or type 2 diabetes. Researchers said that even before the caps, most commercial enrollees were already paying out-of-pocket expenses below the cap amounts.

“What we found was that these caps do not lead to a meaningful increase in insulin use. This is due, in part, to the focus of these caps on patients with commercial insurance coverage subject to state-level oversight,” Anderson said in a

Before the implementation of any state caps, for enrollees with type 1 diabetes, 8.6% of claims had out-of-pocket monthly spending above $100, 12.0% had spending above $75, 20.9% had spending above $50, and 62.5% had spending above $25. For those with type 2 diabetes, 6.4% above $100, 8.9% had spending above $75, 15.5 percent had spending above $50, and 52.1% percent had spending above $25.

After the state caps on out-of-pocket costs, enrollees with type 1 diabetes, 3.0% of claims had out-of-pocket spending above $100, 4.4% had spending above $75, 8.7% had spending above $50, and 33.6% had spending above $25. For those with type 2 diabetes, 2% of claims had spending above $100 for a thirty-day supply, 3.2% had spending above $75, 7.9% had spending above $50, and 38.7% had spending above $25.

The findings of this study confirm those of a separate analysis done by Laura F. Garabedian, Ph.D., M.P.H., and her colleagues at Harvard Medical School and the Harvard Pilgrim Health Care Institute and published earlier this year in the Annals of Internal Medicine earlier this year.

The results reported in the Annals found no different insulin use after an out-of-pocket cap went into effect in eight states in January 2021. Use was measured by how often insulin prescriptions were filled by people with diabetes. The results showed that out-of-pocket expenditures were lower by $11.46 per month in the states with caps compared with a group of 17 states that functioned as a control group.

Newsletter

Get the latest industry news, event updates, and more from Managed healthcare Executive.